Direct Instructional Expenditures – Salary

You should report all Direct Instructional Expenditures from the entire fiscal year so long as those expenditures are coming from the program’s regular instructional budget. Refer to the Direct Expenditures definition when completing this portion of your data submission.

Report all wages paid to support the instructional function in a given department or program during the fiscal year. While these will largely be faculty salaries, be sure to include clerical (e.g., department secretary), professionals (e.g., lab technicians), graduate student stipends (but not tuition waivers), and any other personnel who support the teaching function and whose salaries and wages are paid from the department’s/program’s instructional budget.

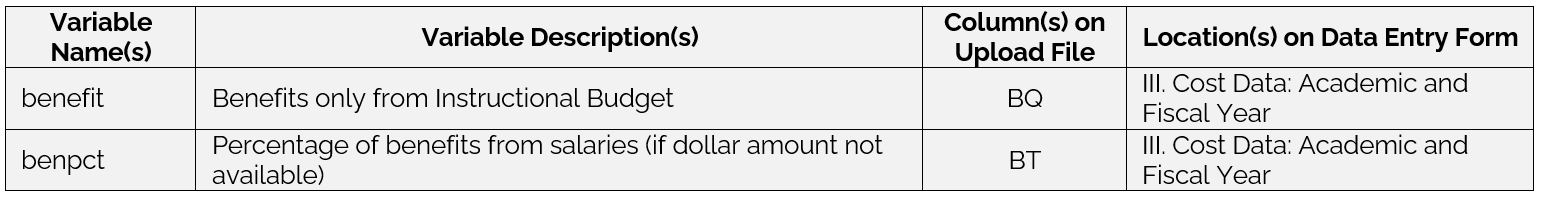

Direct Instructional Expenditures – Benefits

You should report all Direct Instructional Expenditures from the entire fiscal year so long as those expenditures are coming from the program’s regular instructional budget. Refer to the Direct Expenditures definition when completing this portion of your data submission.

Report expenditures for benefits associated with the personnel for whom salaries and wages were reported on the previous entry. Some institutions book benefits centrally and do not disaggregate to the program level.

If possible, provide the appropriate benefit expenditures (in $) for the program. If you cannot provide the expenditures, insert an ‘m’ into the cell and instead provide a benefits percentage (in %). The web portal will automatically calculate the benefits expenditures based on this percentage. Note: If you fill in a value for the benefits $ cell (column BQ), you may leave the benefits % cell (column BT) blank. However, if you are only able to provide the benefits %, you must enter in a value of ‘m’ for the benefits $. This rule applies to both manual data entry in the web portal and the Excel spreadsheet used for uploading data.

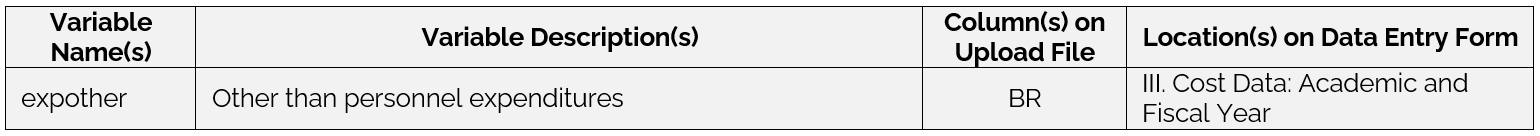

Direct Instructional Expenditures – Other Than Personnel

You should report all Direct Instructional Expenditures from the entire fiscal year so long as those expenditures are coming from the program’s regular instructional budget. Refer to the Direct Expenditures definition when completing this portion of your data submission.

This category includes non-personnel items such as travel; supplies and expenses (e.g. printing and search committees); non-capital equipment purchases (e.g., lab supplies, office equipment, and software); etc. that are typically part of a department or program’s cost of doing business.

Excluded from this category are items such as central computing costs, centrally allocated computing labs, graduate student tuition remission and fee waivers, etc.

Direct Expenditures for Separately Budgeted Research and Service Activities

Refer to the Direct Expenditures definition when completing this portion of your data submission.

Separately Budgeted Research Activity

Report all direct expenditures separately budgeted specifically for research. For the purpose of The Cost Study, you should include all expenditures outlined in the IPEDS definition for “Research”, as long as those expenses can be allocated at the program level.

IPEDS Definition: A functional expense category that includes expenses for activities specifically organized to produce research outcomes and commissioned by an agency either external to the institution or separately budgeted by an organizational unit within the institution. The category includes institutes and research centers, and individual and project research. This function does not include nonresearch sponsored programs (e.g., training programs). Also included are information technology expenses related to research activities if the institution separately budgets and expenses information technology resources (otherwise these expenses are included in academic support.) Institutions include actual or allocated costs for operation and maintenance of plant, interest, and depreciation.

NOTES

- Institutions with interdisciplinary research and service “Centers” should make every attempt to disaggregate expenditures in those centers on a pro rata basis to component programs (e.g. agricultural extension dollars should be reported in the home department of the faculty investigator/coordinator). For those institutions with separate foundations for handling external research and service contracts and grants, funds processed by those foundations to programs should be included.

- Include separately budgeted departmental or institutional funds that were expended for the purpose of matching external research funds as part of a contractual or grant obligation.

- Report the total amount of direct research expenditures. It is not necessary to separate out salaries, benefits, and other than personnel costs for this category.

Separately Budgeted Public Service Activity

Report all direct expenditures separately budgeted specifically for public service. For the purpose of The Cost Study, you should include all expenditures outlined in the IPEDS definition for “Public Service”, as long as those expenses can be allocated at the program level.

IPEDS Definition: A functional expense category that includes expenses for activities established primarily to provide noninstructional services beneficial to individuals and groups external to the institution. Examples are conferences, institutes, general advisory service, reference bureaus, and similar services provided to particular sectors of the community. This function includes expenses for community services, cooperative extension services, and public broadcasting services. Also includes information technology expenses related to the public service activities if the institution separately budgets and expenses information technology resources (otherwise these expenses are included in academic support). Institutions include actual or allocated costs for operation and maintenance of plant, interest, and depreciation.

NOTES

- Report the total amount of direct service expenditures. It is not necessary to separate out salaries, benefits, and other than personnel costs for this category.