Data Dictionary – Full Time Equivalent (FTE) Faculty

Faculty FTE Counts | Regular Faculty | Supplemental Faculty | Teaching Assistants

Faculty FTE Counts

Faculty should be assigned to programs based on the “origin of instructor” method; i.e., their FTE counts, and associated workload, are assigned to the program from which their salaries are budgeted. For example, if a regular full-time faculty member is paid entirely out of the Sociology department’s instructional budget, their 1.0 FTE, along with their SCH and OCS, are credited to the Sociology CIP, regardless of where those courses are taught. Faculty with multiple appointments should have their FTE and SCH/OCS apportioned out consistent with how their salary is being paid.

Note: Faculty counts should be determined using the institution’s fall personnel file. For example: the 2023 cycle examines 2022 fall semester data.

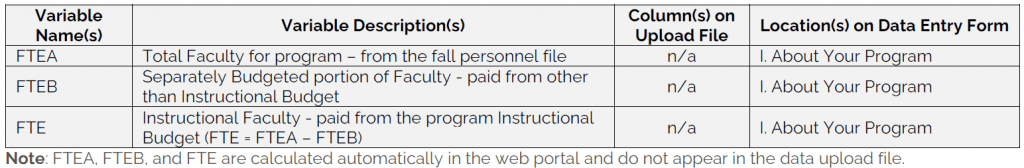

Total, Separately Budgeted, and Instructional

The Cost Study examines three FTE counts at each faculty type: total, separately budgeted, and instructional.

The Total FTE faculty fields should be populated with the TOTAL FTE for filled faculty positions as they appear in the fall personnel file at your institution. Be sure to report filled positions only. Filled positions are those that have salaries associated with them. Include paid leave, such as sabbaticals wherein the individual is receiving a salary, but exclude unpaid leaves of absence. Remember to include the department Chair as 1.0 FTE if they are being paid out of the instructional budget.

The Separately Budgeted fields should be used to capture the portion of regular faculty lines that are supported by external or separately budgeted funds for purposes other than teaching, i.e., research or service. These fields are traditionally used to capture research grants that allow faculty to “buy out” a portion of their instructional obligations. Note: Regular faculty that teach, but who are also expected to do research and service, should NOT have a portion of their FTE apportioned out, unless that research and service is supported by separately budgeted funds outside of the normal instructional budget.

The Separately Budgeted fields should not be used to capture instructional activity that is funded by sources external to the program (e.g., general operating funds). Such activity should be classified as coming from “contributed service personnel”, as referenced in the Supplemental Faculty definition.

Subtracting the separately budgeted FTE from the Total FTE results in instructional FTE counts, which are calculated automatically in the web portal after data entry or upload.

EXAMPLES

- Professor A is a full-time member of the Chemistry faculty. He should be reflected as 1.0 FTE in the “total” column. However, he has secured a research grant that contractually obligates him to spend one-third of his time conducting research. The externally funded portion of his position is 0.33 FTE, which would be reflected in the “separately budgeted” column. As a result, 0.66 FTE will appear in the “instructional” column (i.e., 1.0 FTE minus 0.33 FTE).

- Professor B is a full-time faculty member contractually obligated to both the Math department and the School of Education (50% to each program). Assuming that she is not engaged in any separately budgeted research or public service activities, her FTE should be apportioned 0.5 FTE to the Math department and 0.5 FTE to the School of Education in both the total and instructional columns.

SPECIAL CASES

- Full-year faculty that do not teach in the Fall Semester

- Faculty that are listed in the fall personnel file who do not deliver any instructional activity during the fall semester (but they do during the spring semester) should still be counted in the appropriate FTE Faculty rows, so long as their entire annual salaries are paid for out of the program’s instructional budget. They should appear in both the “total” and “instructional” faculty columns (unless they are entirely separately budgeted).

- Because they are not teaching in the fall semester, they will have no corresponding SCH or OCS.

- You may get an “error” message on the data entry form in the web portal alerting that you have FTE counts but no corresponding instructional activity. Please use the Program Notes box at the top of the form to state that the FTE counts reflect faculty that are paid from the instructional budget but did not teach in the fall.

- The decision to include these faculty, despite them not teaching in the fall semester, mirrors the definition for faculty that are on paid sabbaticals (i.e. they represent a filled faculty line in the fall personnel file, and they are being paid out of the instructional budget, but they are not contributing any instructional activity to the Fall semester or even the full year).

- Please note that the decision to include these faculty will affect the program’s workload metrics in that they will appear “lower” than actual workload expectations/obligations for the regular faculty. However, this is a normal part of the overall conversation surrounding costs and productivity at the program level.

Regular Faculty

Regular faculty are defined as those individuals who are hired for the purpose of doing teaching and/or research, and possibly service. They are characterized by a recurring contractual relationship in which the individual and the institution both assumed a continuing appointment.

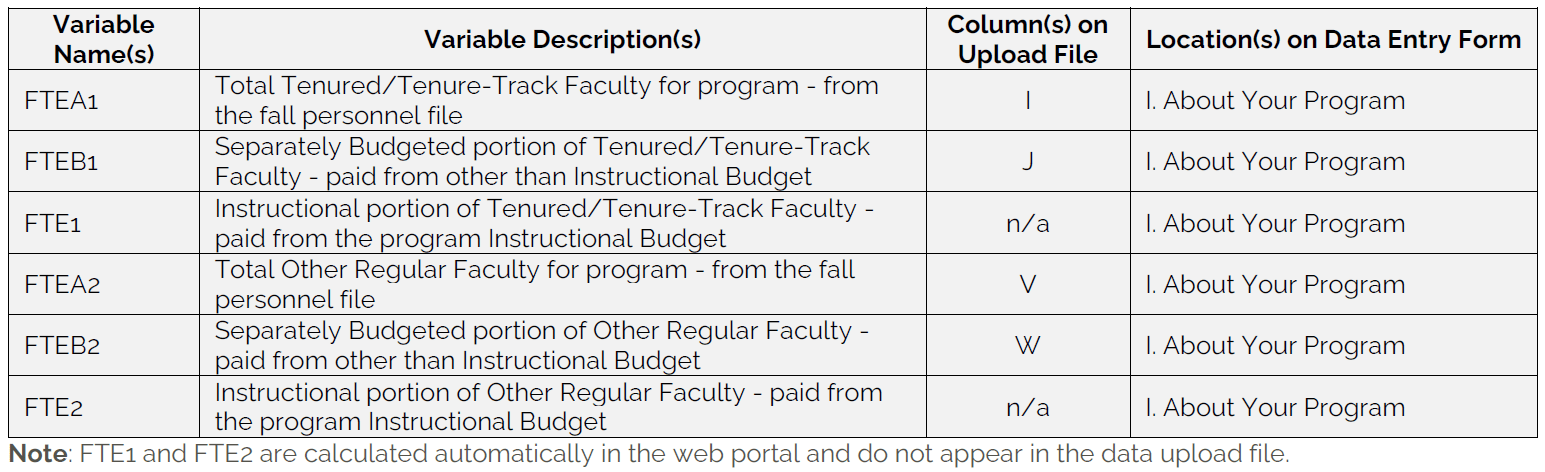

Tenured/Tenure-Track vs. Other Regular

Tenured/Tenure-Track: Those individuals who either hold tenure, or for whom tenure is an expected outcome. At most institutions, these are full, associate, and assistant professors.

Other Regular: Those individuals who teach on a recurring contractual basis, but whose academic title renders them ineligible for academic tenure. At most institutions, these titles include instructors, lecturers, visiting faculty, etc.

SPECIAL CASES

- 100% Separately Budgeted

- You may encounter the scenario where a regular faculty member is 100% separately budgeted to conduct research for the fall semester; however, they still carry a small teaching load. You may include their 1.0 FTE in the “total” column of the appropriate faculty row and apportion out the 1.0 FTE into the “separately budgeted” column, resulting in 0.0 FTE in the instructional column. The instructional activity (SCH and OCS) for that faculty member should then be placed in the Supplemental Faculty row. Use the normal conventions for calculating Supplemental FTE to assign FTE for those courses.

- The personnel costs that support this faculty member’s regular contract should be placed in the expenditures devoted to separately budgeted research activities; however, the additional pay that they receive for their instructional activity should be counted in the instructional expenditures from salaries.

- Research Faculty

- Please use this same convention listed in the previous bullet point to account for Research Faculty who do not traditionally teach but who are contributing instructional activity for the fall semester.

- In both of the scenarios above, if the instructional activity is uncompensated, it should be considered “contributed service personnel” as referenced in the Supplemental Faculty definition. The FTE, SCH and OCS should be counted in the Supplemental Faculty row, but there will be no corresponding expenditures for that instruction.

- Overload Instruction

- In cases where Regular Faculty members are teaching an overload, please count their contracted FTE (and corresponding SCH and OCS) in the appropriate Regular Faculty rows. Their overload (FTE, SCH and OCS) should be counted in the Supplemental Faculty row. Use the normal conventions for calculating Supplemental FTE to assign FTE for those courses. Note: The overload should be attributed to the program that paid the faculty member to teach the course regardless of the faculty member’s home department.

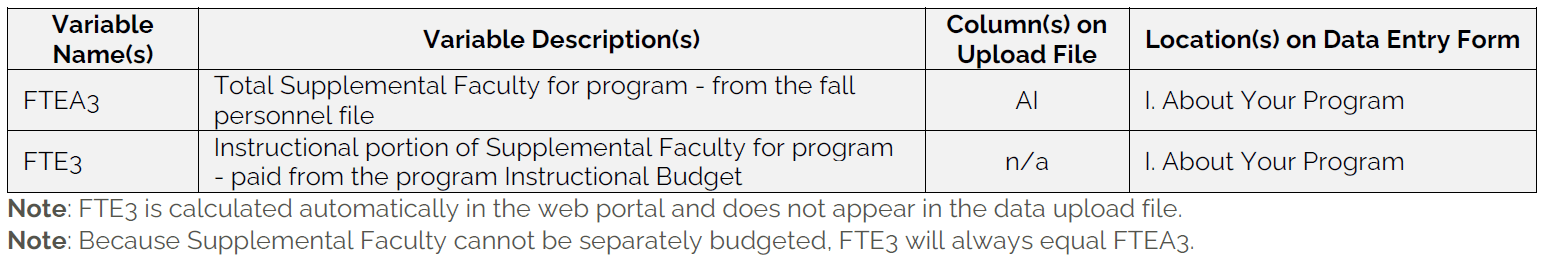

Supplemental Faculty

Supplemental Faculty are characteristically paid to teach out of a pool of temporary funds. Their appointment is non-recurring, although the same individual might receive a temporary appointment in successive terms. The key point is that the funding is, by nature, temporary and there is no expectation of continuing appointment.

This category includes adjuncts; administrators or professional personnel at the institution who may teach a course but whose primary job responsibility is non-faculty (e.g. dean, provost); the overload portion of a Regular Faculty member’s instructional activity; and “contributed service personnel” who teach but receive no additional compensation for teaching. An example of contributed service is the college president who teaches an occasional course but has no paid contractual arrangement for this teaching.

CALCULATING THE FTE OF SUPPLEMENTAL FACULTY

- Full time equivalency for Supplemental Faculty can be calculated by taking the total teaching credit hours (which are generally equivalent to the credit value of the course(s) taught) for each Supplemental Faculty and dividing by 12. A broadly accepted standard for a full-time teaching load is 12 hours. If your institution assigns 1 course unit instead of 3 or 4 credit hours to a course being taught, please contact ire-cost@udel.edu for further instruction.

- While the study does distinguish between credit bearing and non-credit bearing Teaching Assistants, it does not offer a similar breakdown for Supplemental Faculty. Therefore, you will encounter a unique situation when calculating the FTE of Supplemental Faculty that are teaching 0-credit courses. We recommend assigning that FTE based on “expected workload” of the supplemental faculty.

- For example: if a Supplemental Faculty member is teaching a 0-credit lab, but it requires a similar amount of work to a 1-credit class, they should be assigned 1/12 FTE for that course (similarly, a course with a workload similar to a 3-credit course should be counted as 1/4 FTE).

- If it is not possible to determine the expected workload of a course, it could be appropriate to calculate FTE based on the amount of money that is being paid to the Supplemental Faculty for that course. For example, if an adjunct instructor is typically paid $5,000 for a 3-credit course, but they are being paid $2,500 for the 0-credit course, then we can assume that the work is equivalent to 1.5-credits and should therefore be counted at 1.5/12 FTE.

- Ultimately, you should determine a methodology for calculating those FTE that is consistent with the expectations of the supplemental faculty on your campus.

CONTRIBUTED SERVICE PERSONNEL

- Any non-faculty person teaching a course without additional compensation (dean, provost, etc.) is considered “contributed service personnel”. Use the normal conventions for calculating the FTE of Supplemental Faculty outlined above, and report their FTE, SCH and OCS in the Supplemental Faculty row.

- An additional sub-category of contributed service personnel is any faculty that are contributing instruction to a specific instructional program, but they are compensated from a fund outside of the instructional budget of that program AND they are not being compensated by any other instructional program.

- Contributed service personnel are specific cases when a program is benefiting from delivering instructional activity without having to provide compensation for it from their normal instructional budget.

- Compensation for the instructional activity produced by contributed service personnel should not be included in the direct instructional expenditures.

- Because you are unable to follow the “origin of instructor” method with contributed service personnel, you should place the FTE, SCH, and OCS into the program that is responsible for delivering the course.

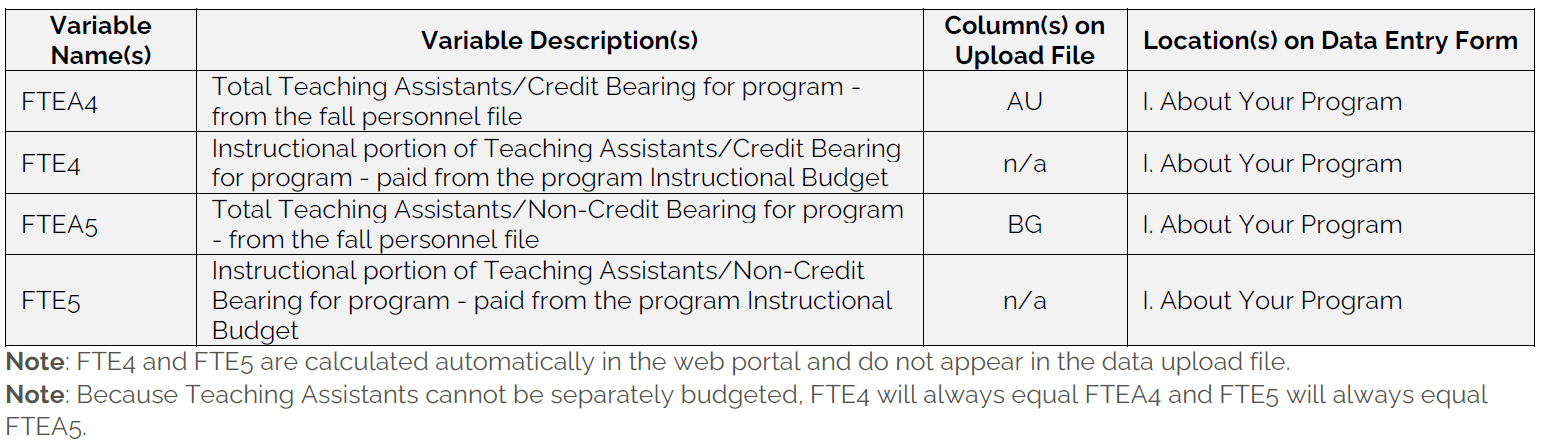

Teaching Assistants

Teaching Assistants (TAs) are students at the institution who receive a stipend strictly for teaching activity.

You are asked to assign an FTE value to TAs, apportioned between credit bearing course activity where the Teaching Assistant is the instructor of record, and non-credit bearing course activity (i.e., section leader for zero-credit laboratories, discussion sections, recitation sections).

Apportion the FTE as follows:

- Begin with the total FTE value for TAs in a given program as it appears in your fall personnel file.

- Credit Bearing Activity: Use the same convention as with Supplemental Faculty. Take all courses which are credit bearing and for which TAs are the instructors of record and divide the total teaching credit hours by 12. The resulting quotient is the TA FTE for credit bearing course activity.

- Non-Credit Bearing Activity: From the total TA FTE included in your personnel file, subtract the calculated FTE for credit bearing activity as outlined above. The difference is the FTE for non-credit bearing activity.

NOTES

- You should include TAs who are instructors of record, and also include TAs who function as discussion section leaders, laboratory section leaders and other types of organized class sections in which instruction takes place but which may not carry credit and for which there is no formal instructor of record.

- For purposes of The Cost Study, do not include graduate research assistants. If a graduate assistant’s FTE is split between research and teaching, only report the portion of their FTE that reflects their teaching activity.

- Non-credit bearing activity for TAs typically refers to zero-credit labs; however, it is understood that on many campuses, the non-credit bearing activity is not exclusively direct instructional activity and may include activities such as grading papers. However, the decision to allow TAs to do things other than teach is synonymous with allowing other departmentally paid faculty types to take reduced loads to engage in non-teaching activity. In both instances, salaries are associated with personnel, and in the interest of consistency, the personnel should be counted as an FTE and as an expense component, as is common practice in higher education.